Still unclear what impact investing actually is? Read our 3-part, expert-written guest series.

Flexible Impact: a sliding scale to dial-in your impact

At Beacon, we have been following recent developments in the impact investing space. From the extension of Social Investment Tax Relief earlier in the year, to the announcement of a government-funded impact investing taskforce just two months ago. We have been asking what these developments mean for philanthropists and social investors.

With impact investing now gaining popularity, customisable financial vehicles are emerging to meet the needs of investors. Blue Impact Fund is one such vehicle. It aims to give individuals the flexibility to boost the impact of their investment according to their priorities.

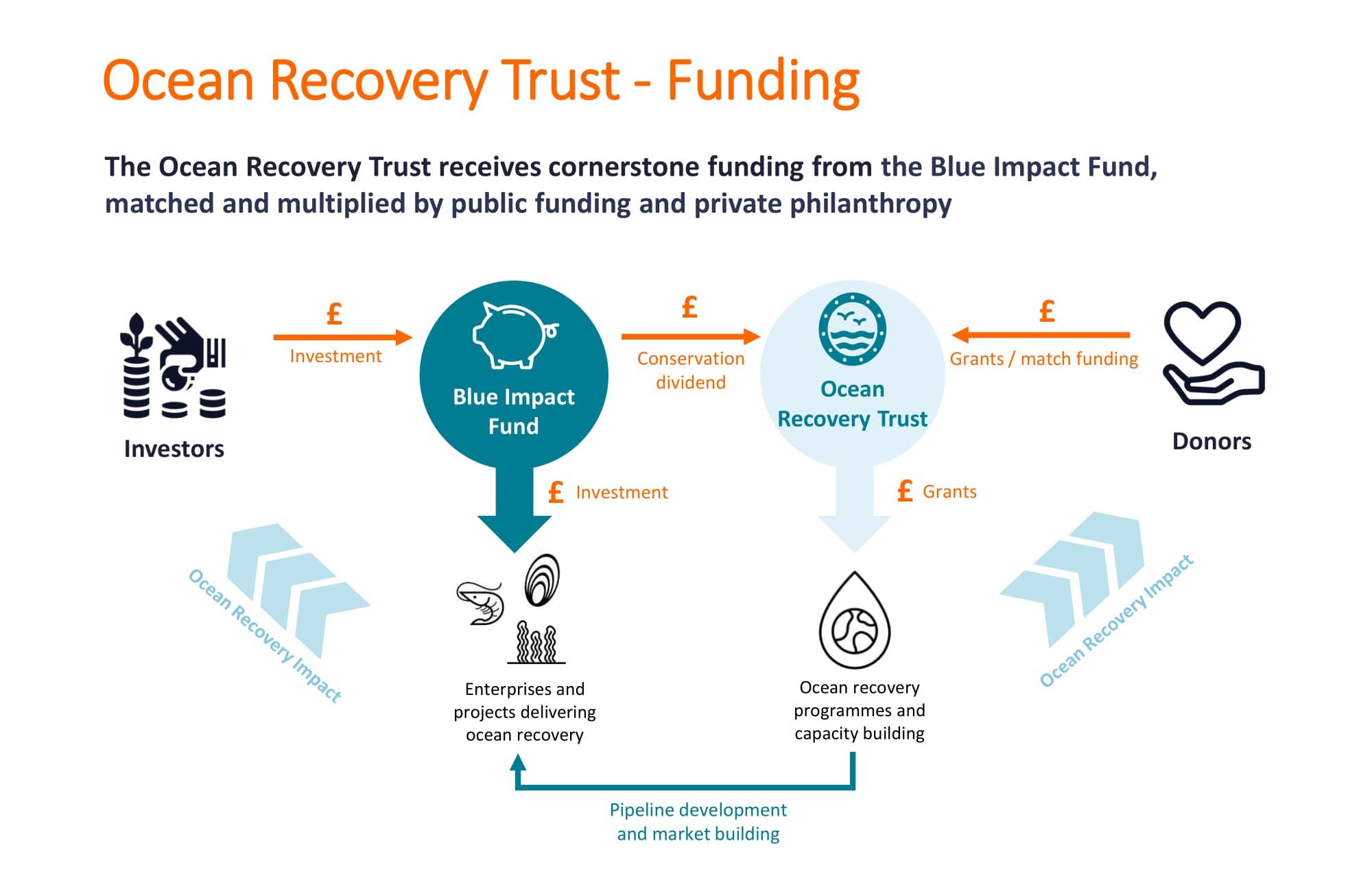

The unique design – the combination of a fund with an adjoining trust – allows investors to ‘dial-in’ the level of impact they want on a sliding scale, based on the financial return they need from their investments. We look at the fund’s ambitions, how it works and what vehicles like this mean for the impact space.

What is Blue Impact Fund?

Blue Impact Fund will invest in the UK sustainable blue economy. The Fund seeks to support and grow commercially-viable business opportunities which protect and enhance marine habitats. Demonstrating the ‘business case’ for sustainable initiatives will – it is hoped – pivot the economy to work with the ocean, not against it.

Finance Earth has partnered with WWF to develop the fund. It will provide repayable finance to businesses addressing what WWF calls the triple challenge of our time. This constitutes:

- Food – how do we secure enough food to feed a growing population?

- Climate – how do we keep the global temperature rise below 1.5 degrees?

- Nature – how do we protect biodiversity, species, and habitats?

The organisations’ research has indicated that public sector and philanthropic funding alone simply cannot bring about the levels of ocean recovery needed to answer this challenge. They believe a third line of finance is required to rebuild and protect the ocean – impact investing.

The Blue Impact Fund will support businesses in growth phase, those between start-up and ‘established’ size. Businesses at this size tend to have fewer options for finance than their smaller or larger counterparts, who can more easily attract either seed funding or mainstream finance respectively.

Boosting impact: Combining the Fund with an adjoining trust

While many organisations in Blue Impact Fund’s pipeline are investment ready, others are not. This realisation precipitated the establishment of a complementary Ocean Recovery Trust. The idea is that the Blue Impact Fund will provide repayable finance to growth-stage businesses, while the Trust supports early-stage enterprises with grants.

The Ocean Recovery Trust will be funded with a percentage of the Finance Earth management fee and carry from the Blue Impact Fund. Alice Millest, Investment Manager at Finance Earth, explains:

“We have some potential investors who only need to preserve their capital rather than achieving close to market returns. These investors have asked us to donate any returns above their floor rate to the Ocean Recovery Trust. This allows investors to have a sliding-scale of impact.

“If they need to maximise financial return, they simply take their full returns and that’s that. But if they want to maximise impact, they can donate any returns in excess of their chosen threshold into the Trust, making more grant money available for catalytic ocean recovery opportunities.”

…And ‘catalytic’ is the key word. The grant-body aims to catalyse early-stage, scalable initiatives as a way of unlocking systems-wide impact. Once a business or project has benefited from an Ocean Recovery grant, it may then be in a position to seek repayable finance from the Blue Impact Fund to continue its growth and impact.

Final thoughts

Impact investing is increasingly gaining attention in the UK. Many people initially considered impact investing as simply a more socially-conscious branch of investment. However, it now seems there is a growing appreciation of the role it can play within individual philanthropy strategies.

Interest begets innovation – and as interest around impact investing grows, so will the opportunities available to philanthropists. The growing impact investing infrastructure is continuing to provide new solutions to philanthropists’ needs – and it doesn’t show any sign of slowing down.