Testing the potential for impact investing, with Rennie Hoare.

In a series of three articles, Scott Greenhalgh*, former executive chair of Bridges Evergreen Holdings, will share his thoughts on the landscape for impact investing in the UK. In this third and final article, Scott looks in more depth at the distinction between finance-first and impact-first equity investing.

* See bottom for more on the author

Impact Investing and the Three Dimensions of Capital

In previous articles, we have defined impact investing as: “investments made into companies, organisations and funds with the intention to generate positive, measurable social and environmental impact alongside a financial return”1. We have also touched on the distinction between finance-first and impact-first investment strategies.

This article describes how different impact fund managers prioritise issues of impact, risk and return (the three dimensions of capital). It also explores impact-related themes a potential investor might wish to explore, with a company or impact fund manager, before deciding whether or not to invest.

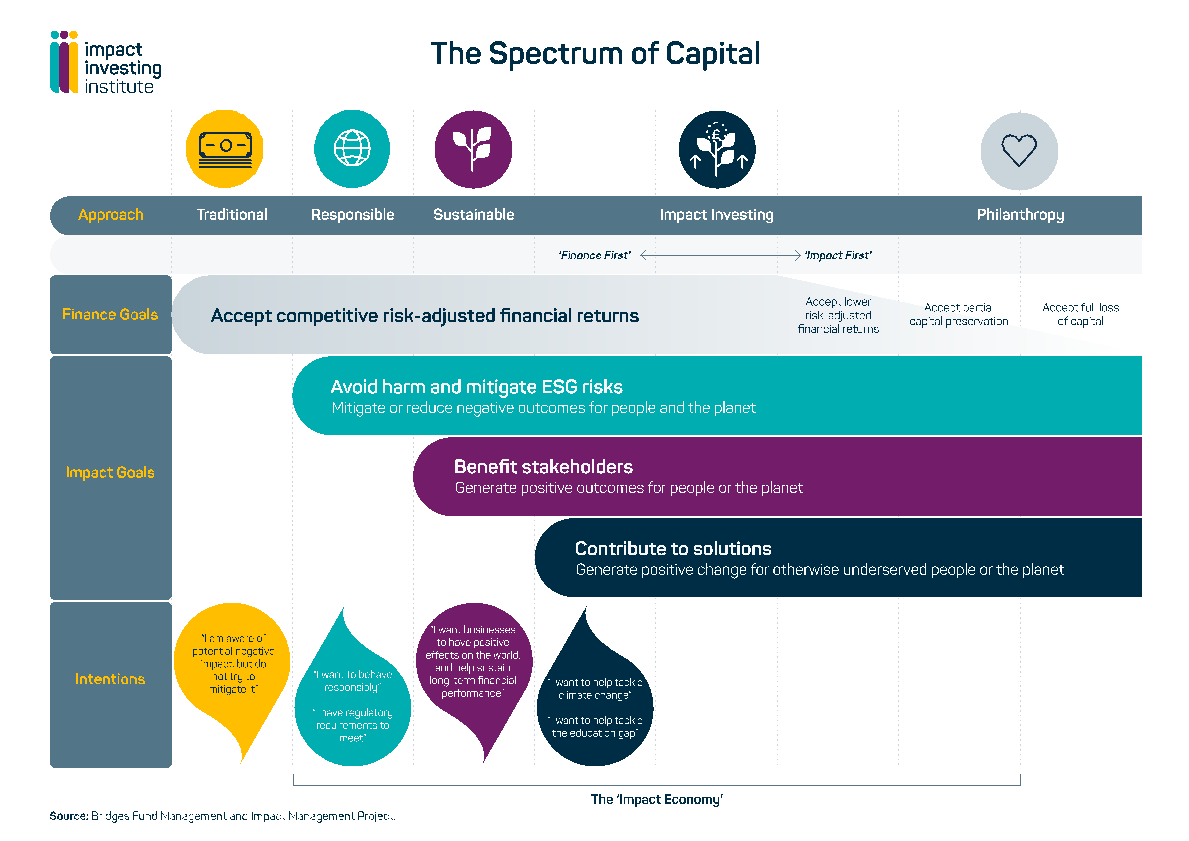

The Spectrum of Capital shown below2 places all investment on a continuum between “traditional” investments at one end (those that seek to maximise risk-adjusted returns with no consideration of wider social or environmental factors) and philanthropy (that seeks only impact and no financial return). This approach positions ethical, sustainable and impact investing on that continuum and allows us to distinguish between impact investing that is finance-first, meaning it aims to deliver impact with no sacrifice of market-rate financial returns, and impact-first, where the investor accepts lower, risk-adjusted returns.

Figure 1: Impact Investing Institute’s Spectrum of Capital.

Finance First

A number of venture capital and private equity funds take a finance-first approach to impact investing. Such funds invest in businesses and aim to achieve market-rate financial returns for the investor at the same time as achieving positive social and/or environmental outcomes. Examples in the UK mid-market include Palatine Impact and Bridges Sustainable Growth Funds. There are an increasing number of impact funds offered by the large investment firms such as TPG, KKR and Bain Capital. There are also a number of “tech for good” early-stage impact investors like Mustard Seed, for example.

The alignment between commercial and impact success is often referred to as lockstep in the impact investing industry. By way of a simple example, a learning support business that provides high-quality, educational materials to schools might be considered to offer lockstep. Put simply, the more it sells to schools, the more children benefit from the materials. In this way, commercial growth is aligned with greater social benefits. The lockstep argument allows businesses to maximise profits, and investors to maximise returns, while achieving positive societal and/or environmental impact.

The finance-first approach applies mainly to profit with purpose private company investing. A 2017 Stanford paper looked at the impact/return profile of investing in social enterprises and found that high-impact social enterprises (as opposed to for-profit businesses), whether in emerging or developed markets, were unlikely to generate more than low single digit financial returns.3

The EVPA characterises finance-first investors as investing with impact. In this definition, the investor will prioritise financial return over impact at each stage of the investment cycle. Therefore, from initial screening through to decisions as to which buyer should be selected on exit, the key metric for the investor is to maximise the financial return.

To return to the school learning materials example above, a finance-first investor would favour private school customers if these paid higher prices than state school ones. If we assume more state school pupils are likely to come from less advantaged households, then the finance-first approach leads to some trade-off in the amount of impact.

A finance-first approach can be described as “maximising” equity return, consistent with mainstream private equity and venture capital investing. In a 10-year fund structure, a five-year investment horizon is typical. Two consequences of this are worth highlighting. First, the investor will be concerned to drive fast growth from the outset of the investment and second, where possible, to use leverage in order to reach the desired financial return.

As I set out in the next section, there are increasing concerns about potential adverse consequences of this investment approach, for example in the provision of public services by the private sector.

Impact First

Impact-first investors focus on achieving a “sufficient” rather than a “maximised” financial return. They therefore also give equal or greater weighting to impact as to risk and return considerations.

What constitutes a sufficient return and how sufficient is defined will be subjective and will vary. For example, the fund I ran aimed for, and was achieving, a 9% net return to investors per annum. At the same time, we took the view that the level of return should not involve having to compromise on the level of positive impact.

Let me give an example. In November 2020, the Children’s Commissioner published a report on private provision of children’s care services in England, raising concerns about the high profits and high debt levels of some private-equity owned companies providing these public services.4

By way of context, there are some 74,000 looked-after children in England, a number that has risen by over 20% in the last decade. This increase in “need” has mostly been provided by private, for-profit business and the private sector now accounts for some 35% of total provision, with local authorities and charities providing the balance.

A number of the larger foster and residential care providers are private equity owned. Private equity funds typically target financial returns on equity above 20% per annum. Achieving these returns requires some combination of tight cost control, rapid “buy or build” growth and the use of leverage.

Using Ofsted inspection ratings as a guide, most of these providers deliver a good standard of care. To my mind however, the key question is: could these entities provide even better care (and outcomes for vulnerable children), if they were seeking profit sufficiency rather than profit maximisation? This question is, of course, contentious and loaded with value-based judgments, but I would argue it is a debate that we should have, as at its heart it is about our societal values.

In January this year, the Secretary of State for Education announced a review into children’s care. It will be interesting to see whether or not this review engages with these issues.

I have used the children’s care sector as an example, but the issues raised apply equally to many aspects of care and other forms of public service delivery by the private sector. Part of the answer, I believe, lies in how impact is defined, measured and reported on.

The Impact Process and Impact Risk

The initial screening of an investment opportunity will consider the following and, in the case of impact-first investors, the investment will only proceed if the impact assessment proves acceptable across the following areas:

-

- the ethos and values of the company and its mission,

- the scale and depth of the impact and the impact score (perhaps using the IMP framework5),

- its ambitions and plans to drive greater impact (perhaps using a Theory of Change model),

- its willingness to measure impact and how that will be done,

- the opportunity for the investor to enhance the impact (referred to as the investors’ additionality).

During the investment period, the investor and the company will then continue to measure and track the change in impact.

Of note, one theme common across the impact investment sector is how few investors use independent assessments to measure impact during the investment period. Genuine independent evaluation of impact can be time-consuming and costly to procure, but arguably it should be done to avoid the risk of “marking one’s own homework”.

At the point of exit too, life is somewhat easier for the finance-first investor. If there is genuine lockstep, then commercial and impact success are intertwined. Logically, this means that any buyer will seek to preserve that lockstep. This means the seller can sell to the highest bidder.

However, where lockstep does not exist- such as in the children’s care example above- the investor needs to consider carefully which buyer is most likely to preserve the mission of the business and the extent of any trade-offs between preservation of that mission, by selling to a like-minded buyer, and the potential to achieve a higher sale price and hence investor return by selling to a more commercially focused buyer.

Another area to consider are the incentives for the fund manager and its investment team. Carried interest or profit share is standard in private equity or venture capital funds. Management fees are also standard and paid as a percentage of assets under management. One issue for investors to consider is the extent to which these incentives are based on impact as opposed to financial performance.

Risk-Adjusted Returns

The Spectrum of Capital above refers to impact-first investing as accepting lower risk-adjusted returns. My view is that this is only partially correct. Some impact-first funds adopt a strategy of taking greater investment risk in return for seeking greater impact return. Others do not.

If we again use the children’s care example above, we can say that an impact-first investor that invests in a care provider will seek business growth at a pace that is consistent with the highest quality of care rather than one that is (at least in part) driven by financial return targets.

This allows more room to focus on the quality of care, staffing, resilience and risk management in all its forms. The lens of “sufficient” profit and financial return therefore arguably reduces operational and reputational risk. It also allows for leverage to be used less and perhaps also for the ownership of the company to be spread more widely. All of these factors should help reduce the investment’s risk profile, meaning that whilst the investor return is lower in absolute terms, it can remain attractive and even competitive on a risk-adjusted basis.

In this article, I have outlined both the finance-first and impact-first approaches to investing and described some of the fault-lines between the two. Each approach has its own and absolutely legitimate place on the spectrum of capital. Where lockstep exists, positive impact and profit maximisation can go hand-in-hand. In other cases, I believe an impact-first, or profit sufficiency, approach may be more appropriate and still offer attractive risk-adjusted returns to the investor.

I expect to see considerable growth in the finance-first segment of the impact investing landscape as more of the mainstream fund managers launch later-stage and buy-out style impact funds.

As will be clear from the above, I also believe that there is a real need for the impact-first segment, both early-stage and growth capital, to flourish. To do this, there is a need both for more capital and for more support from investors who themselves have been successful entrepreneurs and wish not only to invest, but also help build exemplar socially-driven businesses.

Footnotes:

1. Global Impact Investing Network in 2009.

2. See Impact Investing Institute- www.impactinvest.org.uk.

3. “Marginalised Returns” Stanford Social Innovation Review 2017, Bolis and West.

4. Children’s Commissioner “Private provision in children’s social care” November 2020.

5. See www.impactmanagementproject.com.

About Scott Greenhalgh: After a career in private equity, Scott started working 12 years ago with a number of wonderful not-for-profit organisations that opened his eyes to the scale of social inequality and need in the UK. In 2016, he was fortunate to be able to combine these “two worlds” and lead Bridges Evergreen Holdings from inception. Evergreen is the UK’s first long-term capital investment vehicle for social impact investing. Scott is now stepping down from this role and this series of articles offer reflections on leading a pioneering impact first fund. The views in this article are the author’s own and expressed in a personal capacity.