Read the third and final article in the series.

In a series of three articles, Scott Greenhalgh*, former executive chair of Bridges Evergreen Holdings, will share his thoughts on the landscape for impact investing in the UK. This second article looks at the UK social impact investment market and the different types of investment opportunities for investors.

* See bottom for more on the author

The UK Social Impact Investment Market

In the first article in this series, we looked at the Impact Investing Institute’s Spectrum of Capital and the ABC methodology that classifies investments as avoiding harm, benefitting stakeholders and contributing to solutions.

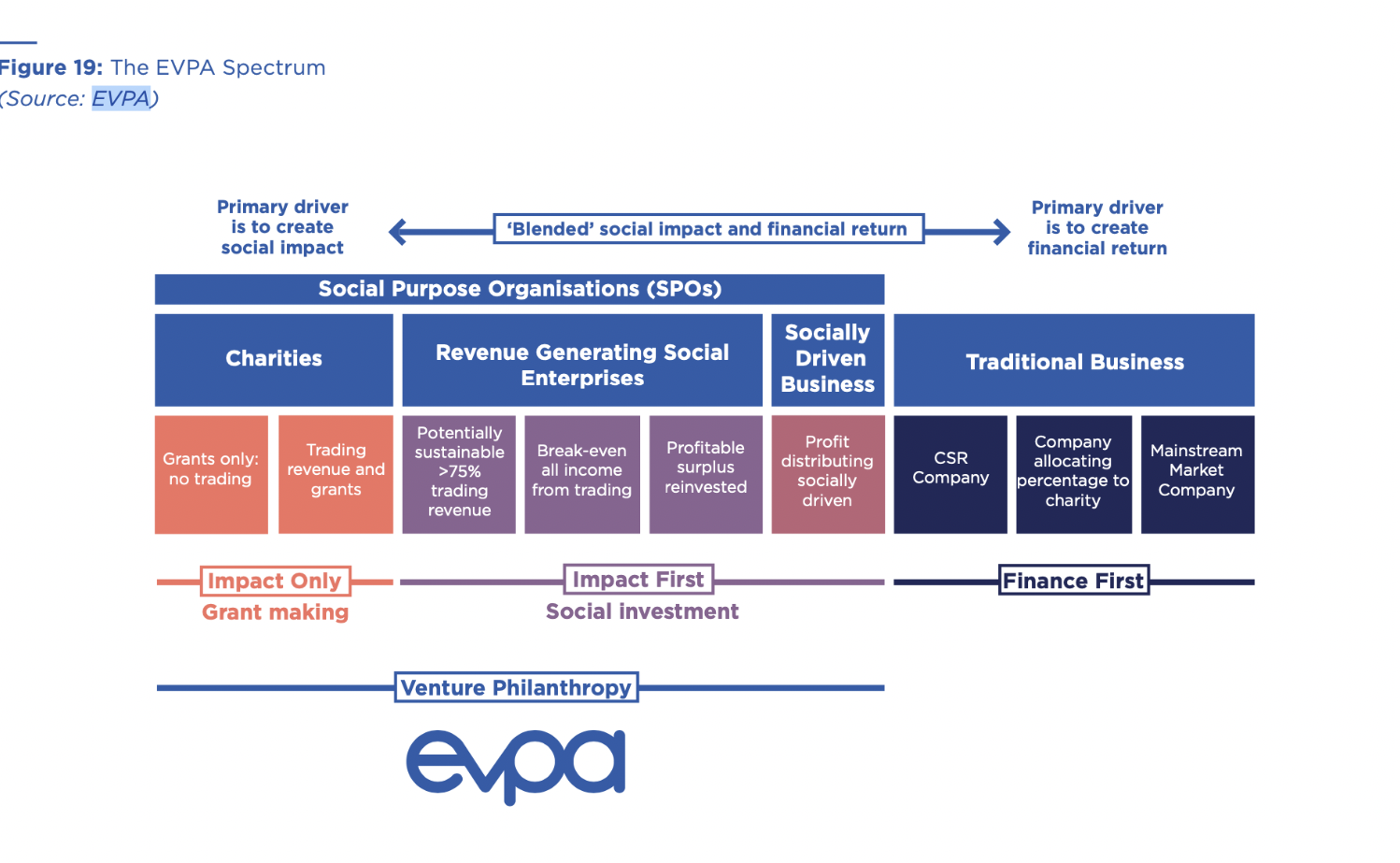

To help define what we mean by social impact investment, we will use the Spectrum of Capital1 from the EVPA. A spectrum of capital offers a continuum on which to plot the purpose of an investment. At one end we have grant-making which seeks a social return and accepts the full “loss” of capital. At the other, we have traditional investment that considers only the two dimensions of risk and return, with no consideration of the social or environmental impact of the entity in which is invested.

Between these two extremes, the spectrum depicts different investment approaches that embrace the three dimensions of risk, return and impact, with the focus on financial return increasing as we move from left to right.

This article focuses on the “UK social impact investment market”. Whilst not a perfect match, this part of the market is broadly consistent with the middle section below which the EVPA defines as Impact First Social Investment on its spectrum of capital2. This segment combines social investment (the funding of charities and not for profits) and impact first equity investing as described below.

Figure 1: Spectrum of Capital from the European Venture Philanthropy Association

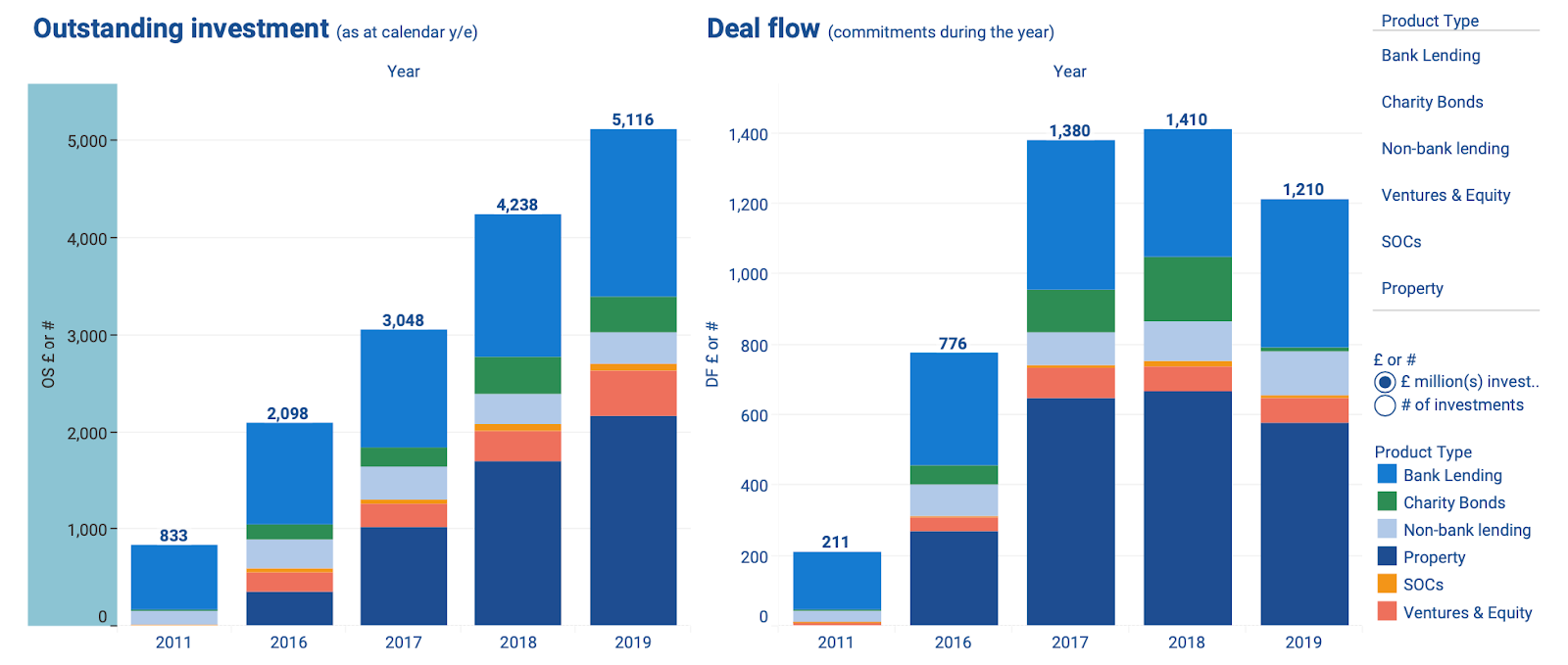

Figure 2: Big Society Capital’s estimation of UK social impact investment market size

Impact first social investments include all return-seeking investment in socially driven businesses as well as lending to charities, social enterprises and socially driven businesses. It excludes at one end philanthropy, which of course makes no financial return, and at the other impact investment, that seeks a full market-rate return (known as finance first investment).

Using a definition that is close to the EVPA one, Big Society Capital estimated the UK social impact investment market at £5 billion in 2019, having grown from £833m in 2011 and with over £1 billion of new commitments in each of the years 2017-2019. This is shown in Figure 2 (above).

Figure 2 also highlights that the UK social impact investment market is dominated by social property investment and various forms of lending to charities and social businesses. These account for c 85% of the £5 billion total.

Venture capital and equity investment into socially-driven businesses has grown but remains small at £473m in 2019. There are some 25 funds in this area, most are early-stage investors. The largest is Bridges Evergreen, which I ran, and which is a later stage investor with £51m of committed capital. Attracting private investors to these new funds has proved a challenge and for the sector to grow, more “enlightened” capital is needed.

There are a range of equity investment opportunities for private investors, but these are fund-based, as yet there are no impact equity angel networks.

Outside of these statistics are a number of much larger sustainability and impact funds that seek market-rate returns. These include early stage “tech for good” investors such as Atomico, mid-market private equity style funds such as Palatine Impact and Bridges Sustainable Growth and the impact funds of major investment firms including those of Bain, TPG and KKR. The launch of more large impact funds is to be expected.

Also, outside of these statistics are ‘fund of fund’ investment opportunities such as the newly listed Schroder BSC Social Impact Trust plc that offers investors exposure to a number of the funds included in the above data, the Snowball fund of fund initiative and portfolios managed by impact focused wealth managers such as Tribe Impact and Rathbones Greenbank, where the investor can align the portfolio with their values and interests.

As will be seen from the above, there are a range of opportunities for investors to invest into funds or entrust their investments to a small number of impact focused wealth managers or fund of funds. There are three broad areas that an investor might want to consider in more detail.

Property and lending

The segment of this market that has grown most rapidly in the past 5 years and now accounts for over 40% of the £5 billion total is property. Social property funds include listed vehicles such as Civitas Social Housing and Triple Point Social Housing REIT, off-shoots of major property firms such as CBRE and DTZ as well as social property specialists including Resonance and SASC that focus on funding property for charities.

Social bank lending forms the second largest segment at around 35% of the total. This is provided by social purpose banks including Triodos, Charity Bank, CAF Bank and Unity Bank. Non-bank lending and the issuance of bonds by charities each account for some 6-7% of the total with much of the bond issuance undertaken via Triodos and Allia, a specialist social enterprise.

These investments are often asset-backed and can be characterised as lower risk/lower return, with yields of between 3-5% pa. Investment liquidity is higher with the listed funds, medium based on matched bargains for many of the bond investments and low in illiquid private fund structures.

Social Outcome Contracts

Social outcome contracts or SOCs are a new and innovative form of public sector contracting pioneered by Social Finance and Bridges Fund Management. The first such contract was in HMP Peterborough, a payment-by-results contract designed to reduce recidivism among those leaving Peterborough prison.

Under a SOC, a public body- for example a local authority- issues a payment-by-results contract which, rather than specifying the service to be delivered, specifies the desired outcome. Payments are based on the extent of achievement of the specified outcomes. Investors fund the contract delivery and only if the specified outcomes are achieved, do the investors recoup their investment and achieve a financial return. In this way social impact success is linked to financial success.

Outcome payments are set at a level that results in a net saving to the public purse; in other words, the cost of paying for outcomes is exceeded by the savings to the public purse through the intervention provided. Return targets are set at some 5-7% net for the investor and one of the attractions for investors is that these returns are dependent on contractual arrangements and therefore are not correlated with market factors.

In the UK, there have been to date some 80 SOCs, mainly investing in the themes of homelessness, vulnerable children and social prescribing (that is support to those with long-term health conditions).

Venture and equity investments

This is the area of the social impact investment market where I hope to see considerable growth. Today, this segment includes some 25 small investment funds. Most are less than 8 years old and so have not been through a full fund cycle. Examples include funds from Impact Ventures UK, Nesta, Big Issue Invest and Bridges Evergreen.

These funds invest to build Socially Driven Businesses, as depicted in the EVPA spectrum of capital. They are avowedly “impact first”, in other words while they seek an attractive financial return for the investor, they do not pursue return as a priority over the social or environmental impact of the investment. (I will focus more on the distinction between finance first and impact first investing in the third article in the series).

Most of these funds are early-stage investors. It follows that these are illiquid investments, higher risk as a result of the stage of investment and therefore attract investors willing to accept these risks in return for the potential high social impact that the funds can deliver.

From my own experience of building a later stage impact first fund, it is possible to reduce investment risk and generate returns of around 9%+ net to the investor. It is also possible to reduce the risk profile of these later-stage investments and so offer the investor an attractive risk-adjusted return. (I will focus on how in the third article). The early-stage impact first funds could potentially generate much higher returns.

On the demand side, there are many mission-driven entrepreneurs seeking to build socially-driven businesses in the UK. These entrepreneurs will typically want to select their investment partner based on values alignment and support to be both commercially successful and deliver positive social impact, rather than on financial criteria alone.

On the supply side, as many of the investment funds are small and lack a track record, it is hard for institutional investors to allocate meaningful capital to this sub-sector. So far, these funds have been championed by Big Society Capital and a small number of committed endowment funds and private HNW investors that want to see the impact first sector flourish. To enable this segment of the market to grow, it is imperative that the supply of capital increases, and this will most likely come from wealthy individual investors in the immediate future. We need more of them!

In the third and final article in the series, Scott looks in more depth at the distinction between finance first and impact first equity investing.

Footnotes:

1. Source: European Venture Philanthropy Association

2. Please note this Spectrum of Capital differs from the Impact Institute one in the previous article.

About Scott Greenhalgh: After a career in private equity, Scott started working 12 years ago with a number of wonderful not-for-profit organisations that opened his eyes to the scale of social inequality and need in the UK. In 2016, he was fortunate to be able to combine these “two worlds” and lead Bridges Evergreen Holdings from inception. Evergreen is the UK’s first long-term capital investment vehicle for social impact investing. Scott is now stepping down from this role and this series of articles offer reflections on leading a pioneering impact first fund. The views in this article are the author’s own and expressed in a personal capacity.