UK Donor Advised Fund Assets Reach £1.7 billion

2019, the year before Covid-19, may seem like a distant memory. Yet, even before the crisis, UK philanthropy was on the march. In the closing hours of 2020, National Philanthropic Trust UK (NPT UK) published its fifth annual UK Donor Advised Fund Report, showing charitable assets under management in UK donor advised funds reached £1.7 billion in 2019. The report also shows a sizeable 53% increase in grants made from Donor Advised Funds (DAF) in the UK in 2019 compared to the previous year.

These results relate to assets that have been set aside for charitable purposes by wealthy individuals and which are managed by donor advised fund providers like NPT UK, Charities Aid Foundation, Prism the Gift Fund, Stewardship, Shared Impact and Charities Trust. Some private banks like UBS and C. Hoare & Co. also offer DAF services.

View the full DAF report here

It might seem like surprising growth for a year that was dominated by heated Brexit wrangling in the UK, but there were two forces at play. Firstly, the UK donor advised fund market is maturing. More individuals are contributing larger amounts to DAFs, showing greater understanding of the role they can play as a replacement for a trust or foundation. Providers also reported their international donors increasingly recognise the value of DAFs to streamline their cross-border activity and provide consolidated reporting on complex giving portfolios.

Secondly, the uncertainty of 2019, linked to Brexit and the Johnson versus Corbyn election, resulted in a number of individual donors opting to make big gifts in the face of uncertainty around future tax and regulatory arrangements. This resulted in sizeable swings in the data.

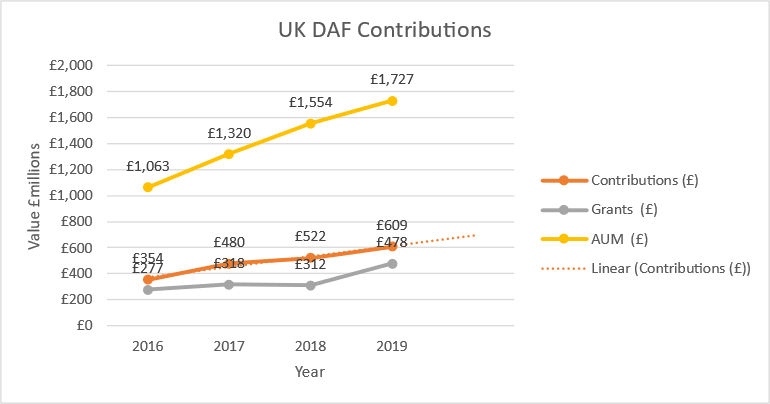

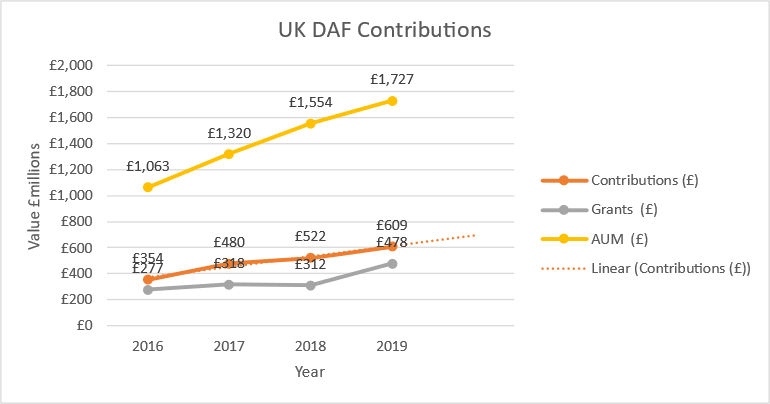

Across the board, the results for 2019 show continued double-digit growth for the UK Donor Advised Fund market. The compound annual growth rate in the assets under management in UK DAFs is 15% from 2015 to 2019. Growth in assets under management reflects the surge in contributions over the last five years, with a compound annual growth rate of 20.5%. In 2019, contributions hit an all-time high in the UK at £609 million. Donors are not just parking their assets in these tax efficient vehicles, grants were also up significantly at £479 million

Figure 1: Contributions to, grants from & Assets Under Management in UK Donor Advised Funds

Source: data sourced from NPT-UK, Donor Advised Fund Report 2020.

These were healthy vital signs for UK philanthropy going into the Covid-19 crisis, and, according to several DAF providers, high-levels of giving continued through 2020 with big increases in grants. Although year-end data won’t formally be collated by providers until later this year, these reports suggest those with assets set aside for charitable giving have been actively deploying those funds to support good causes through the pandemic, in spite of economic uncertainty.

However, Covid-19 will put constraints on the donor advised fund sector. In particular, providers are anticipating the pandemic may affect contributions to DAFs in the coming year as it is harder for them to connect with new clients through virtual channels, especially as many are reliant on wealth managers for client introductions. Many DAF providers offer an active programme of outreach and education to the UK wealth management sector to spread the word to clients about the tax and administrative benefits of giving from a DAF account. Those programmes have been set back by the pandemic.

It is a salient reminder that philanthropy grows when wealth holders are actively engaged and supported to give. It will take a concerted effort by providers and the wider wealth management industry to maintain the levels of growth we have seen in Donor Advised Funds in recent years through 2021. As the effects of the pandemic continue to be felt, we expect wealthy individuals will want to maintain their support for the charitable sector in the UK. If they are encouraged to do so, the benefits of giving via a DAF will more relevant than ever before.

By Cath Dovey, co-founder of the Beacon Collaborative and independent consultant to the NPT UK Donor-Advised Fund Report.